Hang around in the tech industry long enough and you or someone you know will be heard saying, “that’s so crazy it just might work.” Two years ago, if you’d have told me that an open-source, P2P currency would soon be a thriving, billion-dollar market, I would’ve told you that you were on a lonely bus headed to CrazyTown, U.S.A. But today, Bitcoin officially became a crazy idea that’s actually working.

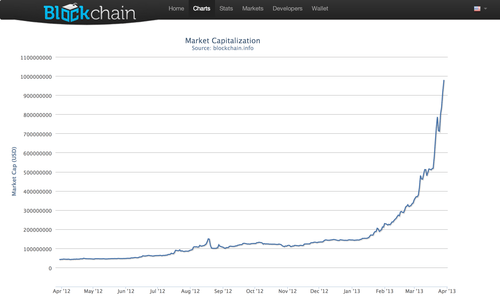

Today, all the Bitcoin in circulation — some 10.9 million of them — have collectively crossed the billion-dollar mark. As it is wont to do, the value of Bitcoin (and its exchange rate) has fluctuated wildly today. At one point, it hit a dollar value around $78, then pushed into the mid-nineties. As of this minute, it’s hovering around $90.

Okay, it’s still a tiny fraction of Google’s market cap, but this is something — especially for a largely unregulated, decentralized virtual currency. (Say that three times fast.) The world’s most popular controversial crypto-currency, mind you.

Bitcoin supporters will scoff and tell you that this is no news, and that Bitcoin has been alive and thriving for years. In fact, it first appeared back in 2009, and has been slowly gaining steam since. But Bitcoin has largely remained outside the realm of mainstream media attention, because no one has been quite sure what to make of it. Is it a passing fad, a hilarious geek-driven phenomenon, or the real deal?

In fact, it has really been relegated to the realm of the uber geeky, or seen as the currency of anarchists or crazy digital libertarians. The black market marketplace known as Silk Road, which allows pretty much anyone to anonymously sell “alternative products” (i.e. large quantities of one’s drug of choice), uses Bitcoin for its currency. Something which hasn’t exactly helped Bitcoin’s “cross over” appeal.

And geeks have had a point: Eventually, with the increasing popularity of P2P networks, virtual currency and digital marketplaces, it was only a matter of time before these entities would collide and a virtual currency of record would emerge. No government control?! Even better!

Bitcoin crossing the $1 billion threshold may not seem like much, but if anything, it seems to be a sign to anyone listening that the crypto-currency is ready to be taken seriously. Of course, there are still a lot of concerns, as John Biggs laid out in 2011.

But why has Bitcoin become a billion-dollar market?

First off, startups are beginning to carry the torch. As Alex wrote yesterday, Expensify announced that it is now supporting Bitcoin “to give international contractors an alternative to PayPal and the high fees associated with the service.” Reddit has jumped on the bandwagon, too, along with WordPress and Namecheap, among others.

Adam Draper, the founder of Menlo Park-based accelerator, Boost VC, recently announced that the team would be focusing on Bitcoin-focused startups for its summer class. As he laid out in a post today, one of the other big reasons Bitcoin is beginning to take off — besides, of course, that it allows secure digital transactions without transmitting personal information — is that investor confidence is growing. Bitcoin startups are beginning to raise, and Draper claims that their fund is far from being the only one that’s interested.

What’s more, the government has finally realized that it needs to start taking virtual currency seriously and develop a strategy for dealing with these types of currencies. FinCEN recently put out a series of“Guidelines,” which will inform future regulation, but also works to establish trust and credibility for virtual currency, particularly Bitcoin.

There’s also the climate of the global financial markets, particularly the panic in Cyprus, after the government froze its citizens’ bank accounts following its bailout. Many believe that the tenuous financial markets in Europe and beyond create an atmosphere that’s ripe for a digital panacea like Bitcoin.

Of course, the other side of the Bitcoin argument is that the confluence of unsteady financial markets, and skyrocketing growth of virtual currency (plus hype), is creating a perfect storm that equates to Bitcoin just being one giant bubble waiting to pop.

What’s more, as my colleague Greg Kumparak pointed out today, Bitcoin itself is still in a tenuous place, policy-wise. There’s a good chance that a decentralized, unregulated market is going to scare the pants off the government once it’s fully cognizant that Bitcoin is a billion-dollar market — and growing. “It’s the easiest ‘this funds terrorism’ scare argument the government will ever try to make, so a big battle within the next year or two is pretty much guaranteed,” he said.

Whether one sees it as a phenomenon or a legitimate institution, Bitcoin is working on all cylinders to become the latter — and now has a real case for our undivided attention. Either way, feel free to marvel at how a virtual currency that appeared practically out of the ether (created by some phantom mathematician/economist) just pulled a billion-dollar market out of its hat.

See you on Silk Road?

No comments:

Post a Comment